info@akcagric.co.uk | 01380 724 687

Basis Period Reform

Basis Period Reform

Basis Period Reform

What is it?

HMRC has announced a reform in the basis period to take effect from the 2024/25 tax year. Businesses currently draw up annual accounts to the same date each year called their ‘accounting date’. From 2024/25 annual accounts will have to reported for the tax year 06/04/2024-05/04/2025 rather than by the accounting period, with a transition year in the 2023/24 tax year.

Who will be affected?

It will affect self-employed traders, partners in trading partnerships & all other unincorporated businesses with trading income such as trading trusts & non-resident companies with trading income charged to Income Tax.

This will only affect businesses which draw up annual accounts to a date different to 31 March or 5 April.

Objectives of the reform.

The reform aims to create a simpler, fairer & more transparent set of rules for the allocation of trading income to tax years

Transitional Year

In the transitional year, businesses that do not have an accounting year end date between 31 March and 5 April will need to recognise two profit elements:

- The ‘standard part’ – being the profit on the 12 months’ worth of trading beginning with the start of the basis period ending in the transitional year.

- The ‘transitional part’ – being the profits in respect of the period beginning immediately after the end of the basis period & ending on 5 April 2024.

Businesses can deduct any overlap relief they may have and any remaining transition profits can then be spread over a period of up to five years.

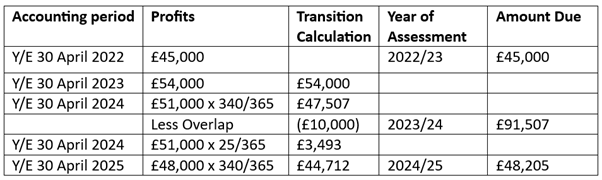

Example – profits in standard and transition part:

Farmer B has a year end of 30 April and has overlap profits of £10,000. His profits are as follows

- 30 April 2022 £45,000

- 30 April 2023 £54,000

- 30 April 2024 £51,000

- 30 April 2025 £48,000

Farmer B has additional amounts assessable because of the ‘transition part’ (£47,507 less 10,000 overlap)

Farmer B can either elect to be assessed on the transitional sum of £37,507 in the transition year or over 5 years (£7,501 from 2023/24 to 2026/27 with the balance assessed in 2027/28)

What happens if you don’t change accounting date?

Businesses that choose not to change their accounting period to align with the tax year will have to apportion figures from two accounting periods to report taxable profit on each tax return from 2023/24 onwards. If the accounts for the later of those two accounting periods have not been finalised by the tax return submission date, provisional or estimated figures will have to be used.

Example:

Partnership C has an accounting period of 31 December

For its 2025/26 tax return Partnership C must apportion figures from its 2025 and 2026 accounts. The 2026 accounts will not be finalised for the 2025/26 submission deadline of 31 January 2027, so estimated figures will have to be submitted. Those estimates will be finalised and reported by 31 January 2028.

The partners of Partnership C will have to wait until January 2028 to finalise their own tax returns for 2025/26.

Next Steps?

Contact your accountant to discuss the best way forward for your business.

If you would like any assistance with the above, or would like to talk to a member of our accounts team to understand further how this will impact your business, feel free to contact us on 01380 724687, or email us at info@akcagric.co.uk