info@akcagric.co.uk | 01380 724 687

HMRC changes to VAT penalties and interest

HMRC changes to VAT penalties and interest

HMRC have announced changes to VAT penalties and interest charges.

The new penalties will impact businesses who submit their VAT returns or pay their VAT late. The first monthly returns and payments affected by the penalties are due by 7 March 2023.

The late payment penalties and points-based late submission penalties were introduced from 1 January 2023, replacing the VAT default surcharge, and apply to accounting periods which start on or after that date.

The penalties for late VAT returns also apply to businesses that submit nil returns and repayment returns.

The changes to VAT penalties and interest payments are:

Late submission penalties

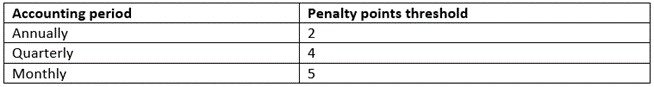

This is now calculated on a points-based system. For each VAT return submitted late, HMRC customers will receive a penalty point until they reach the penalty point threshold – at which stage they will receive a £200 penalty. A further £200 penalty will also apply for each subsequent late submission while at the threshold, which varies to take account of monthly, quarterly and annual accounting periods.

Late payment penalties

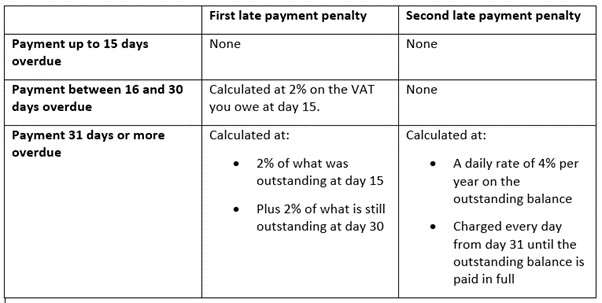

If a VAT payment is more than 16 days overdue, businesses will pay a first late payment penalty. If the VAT payment is more than 31 days overdue, the first late payment penalty increases and a second late payment penalty will also apply.

To help customers get used to the changes, HMRC will not charge a first late payment penalty on VAT payments due on or before 31 December 2023, if businesses either pay in full or a payment plan is agreed within 30 days of the payment due date.

Payment plans

HMRC will help businesses that cannot pay their VAT bill in full. HMRC customers may be able to set up a payment plan to pay their bill in instalments. After 31 December 2023, if a HMRC customer proposes a payment plan within 15 days of payment being due and HMRC agrees it, they would not be charged a late payment penalty, provided that they keep to the conditions of the payment plan. Late payment penalties can apply where proposals are made after the first 15 days, but the agreement of the payment plan can prevent them from increasing.

Repayment interest on VAT credits of overpayments

If HMRC is late in making a VAT repayment, you may be entitled to repayment interest on any VAT that you are owed. This replaces the repayment supplement.

You are not eligible for the repayment interest if you overpay HMRC in error or if you have any outstanding VAT returns.

Repayment interest is paid at the Bank of England base rate minus 1%, with a minimum rate of 0.5%.

For more information visit VAT penalties and interest - GOV.UK (www.gov.uk)